Agency accounts are used when the university does not have ownership of funds. This means that the disbursement of these funds is not subject to the same level of control and restrictions as University funds.

Accounts are an essential part of a strong agency, and should be managed regularly to prevent costly errors. Here are a few reasons why you should consider switching to an agency account:

A well-organized chart of accounts

A well-organized chart of accounts (CoA) is the foundation of your company’s financial reports. A COA categorizes primary accounts into five major account type categories: assets, liabilities, equity, revenue and expenses.

A standard COA includes account naming, reference numbers and descriptions. This coding system makes it easier to find specific accounts, making data entry and reporting more efficient. It also ensures consistency for all department employees, preventing errors.

The accounts in a COA are divided into categories, such as cash, inventory and fixed assets. Each category can then be further broken down into sub-accounts, like petty cash and office supplies. Each account has two sides, debit or credit, that correspond to the accounting equation: Assets = Liabilities + Equity. A well-designed COA is logical and easy to read. It allows you to see the peaks and valleys in your business’s income, how much money you have at your disposal, and how long it should last given average monthly expenses.

Comprehensive financial reporting and analysis

Having access to comprehensive financial reporting and analysis is essential to any business. This level of information not only enables you to improve your financial efficiency, but it also ensures that you remain fully compliant — a crucial component of commercial success.

In addition to a full set of reports, an agency account enables you to apply payment amounts directly to individual charges for subsidized children. This allows you to easily identify and correct any overpayments and underpayments.

Agency accounts are established to hold resources for third party entities that provide activities of benefit to the university community. The university acts as custodian and fiscal agent, but does not exercise the same level of control over the funds as it does for its own funds. This accounts are not included in the university income statement and do not receive campus recharge rates. Agency account disbursement transactions are subject to general UC policies and reasonable internal controls.

Improved financial management

If you’re looking for better investment management expertise but don’t have the time to spend researching individual stocks, consider setting up an agency account. Many community banks and financial institutions offer investment agency accounts that can manage assets on your behalf based on broadly stated investment goals. Fees for these services vary.

The Agency Owner role is the primary user in agency account management, enhancing decision-making and communication processes. This role also streamlines ownership transfer, contributing to efficient and effective operations.

There’s often a disconnect between accounting reports and what you see in your bank account. A cash flow management system like profit first gives you control back by clearly showing if your business is generating enough revenue to cover expenses. This can be an excellent way to prioritize your business’s profitability and avoid wasting money.

Flexibility

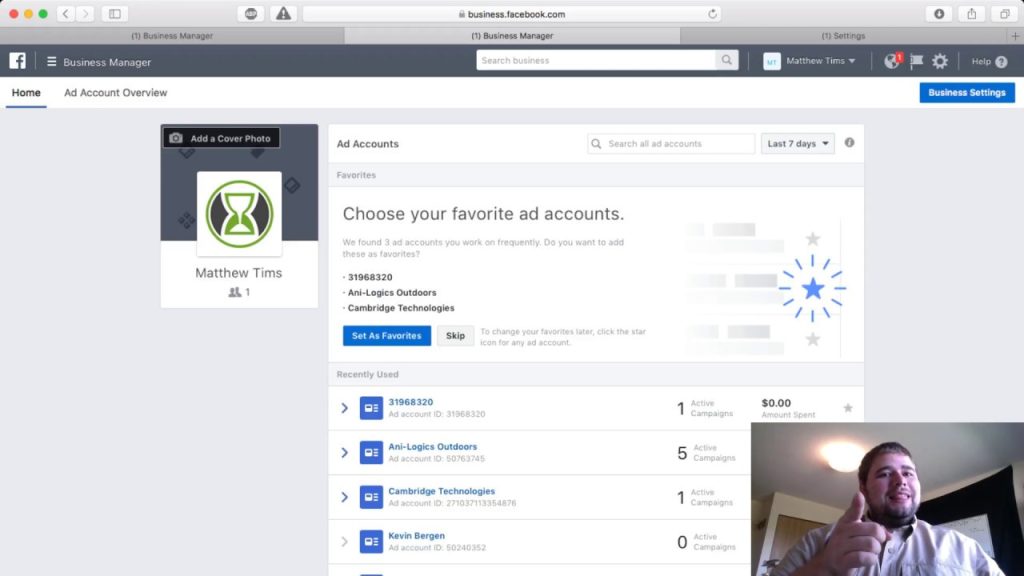

Agency accounts allow marketers to create and manage multiple client accounts in a single platform. This helps increase productivity and ensures that each account is receiving proper attention. It also allows for more accurate tracking and reporting.

A successful agency will use a variety of metrics to measure its performance, including client retention rate, client satisfaction score, cross-sell and up-sell rates, and net promoter score. These metrics are a good way to gauge how well an agency is performing and whether it needs to change its approach.

Agencies should also track their revenue and profit, as well as their operating expenses. This can be done through cash-based or accrual accounting. If the agency uses cash-based accounting, it should complete Signature Authorization forms in Data Warehouse and follow campus policy by notifying BFS when authorized signers change. Also, it should deposit funds in the Agency Account as needed to cover overdrafts, no later than fiscal close each year.